A strategy that does well by doing good.

As more and more investors inquire about integrating ESG considerations into their portfolios, institutions who face a fiduciary responsibility to act in the best interest of their stakeholders and deliver on expected investment outcomes are seeking seamless ways to achieve this new dual mandate that is complimentary to their well-established portfolio framework.

The Quality ESG (QESG) strategy implements a unique Environmental, Social and Governance integration strategy, alongside a proprietary quality factor screen, to quantitatively target companies with both financial and non-financial sustainability. By incorporating ESG metrics, eliminating exposure to companies involved in objectionable business lines, and avoiding exposure to the least financially sustainable companies, the QESG strategy is designed to generate consistent outperformance with an emphasis on both risk and cost efficiency.

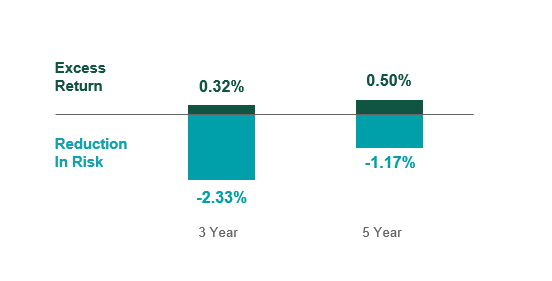

Northern Quality ESG Strategy Vs. Russel 1000 Index (Net of Fees)1

Outperformed the Russell 1000 index 97% of the time with 82 bps average outperformance over three year rolling periods2

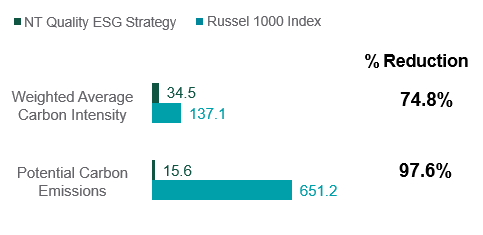

Northern Quality ESG Strategy Lowers Carbon Footprint3

Achieved a 97.6% reduction in Potential Carbon Emissions compared to Russell 1000 index4

IMPORTANT INFORMATION:

Northern Trust Asset Management (NTAM) is composed of Northern Trust Investments, Inc. (NTI), Northern Trust Global Investments Limited (NTGIL), Northern Trust Fund Managers (Ireland) Limited (NTFMIL), Northern Trust Global Investments Japan, K.K. (NTKK), NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited (TNTCHK) and The Northern Trust Company (TNTC). For purpose of compliance with the Global Investment Performance Standards (GIPS®) the firm is defined as Northern Trust Asset Management Services, a subset of NTAM, and includes those investment products managed by NTI, NTGIL, NTKK, TNTCHK and TNTC that are distributed through global channels.

As of 03/31/2021 Northern Trust Asset Management had assets under management totaling $1.19 trillion of which $1.12 trillion is part of the GIPS firm. Northern Trust Asset Management Services claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Northern Trust Asset Management Services has been independently verified for the periods 1/1/1993 to 12/31/2019. The verification report(s) is/are available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

Returns presented are time-weighted returns. Valuations are computed and performance is reported in US dollars. Information regarding policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request. A complete list of Northern Trust Asset Management Services composite descriptions, limited distribution pooled funds descriptions and list of broad distribution pooled funds are available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Past performance is not indicative of future results. Returns for periods greater than one year are annualized. Gross performance returns shown do not reflect the deduction of investment management/advisory fees, assume the reinvestment of dividends and capital gains, and are net of transaction costs and other expenses. Performance results will be reduced by the fees incurred in the management of the account. Annual fee schedule: First $50 million = .40%, Next $50 million = .35%, Above $100 million = .30%. This composite includes pooled funds. The highest investment management fee for the mutual fund(s) is .37%, the highest net expense ratio is .49% and the highest gross expense ratio is .65%, as of the fund(s) most recent fiscal year end. To illustrate the effect of the compounding of fees assuming an annual gross return of 8% and a total expense ratio of .65%, a $1,000,000 account would grow in value over five years to $1,469,328 before fees and $1,422,762 after the deduction of fees. The fee illustration represents the deduction of the highest applicable fee. Investment management/advisory fees are described in Northern Trust Investments, Inc. Form ADV Part 2A. Performance results (or fees) are provided by Northern Trust Investments, Inc. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

The NT Quality ESG LC Composite consists of portfolios indexed to the Russell 1000 Index following proprietary processes The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market. These portfolios are managed to effectively minimize tax liability. This composite may include accounts that restrict the investment of income. The composite was created in October of 2015, and the inception date is September 1, 2015. Financial leverage is not employed as a part of the overall investment strategy of this composite. Financial derivatives, in the form of futures contracts, options and ETF’s may be utilized for the purposes of liquidity, market exposure, or investment opportunity. The internal dispersion of annual gross returns is measured by the standard deviation across asset-weighted portfolio returns represented in the composite for the full year. The three year annualized standard deviation is calculated using monthly gross returns. If the composite has been open for less than three years, the three year annualized standard deviation is deemed not applicable. If fewer than 5 portfolios are in the composite for a full year, internal dispersion is deemed not applicable. The 3-year ex-post standard deviation is not shown for 2015-2017 since 36 months of return data is not applicable. The minimum asset size of a portfolio for initial inclusion in the composite is $450,000.

© 2020 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For more information, read our legal and regulatory information about individual market offices.